A Smart Way to Build Credit is Here: How Perpay+ Can Help You Grow

If you've ever felt like building credit is too hard, or too confusing, we might be able to help. We believe everyone deserves a simple, affordable way to build a strong credit history, and that's exactly what Perpay+ is for.⁺

Perpay+ adds credit factors to your profile, which can help increase your score over time. This progress can help unlock more financial opportunities for you down the road.

This guide breaks down the unique benefits of Perpay+ and is part of our complete resource on the Tools to Build Credit.

How Perpay+ Makes Building Credit Straight-Forward

Building credit doesn't have to be a confusing guessing game. Perpay+ offers a clear, simple path that can help you make progress without the stress.

Get Started in Seconds with No Credit Score Impact to Apply

You can apply for Perpay+ in just 30 seconds.

Applying will not impact your FICO® or VantageScore® credit scores.*

Unlock Spending Power and Credit Reporting

Once approved, you'll get a spending limit of up to $1,000.

For just $5 a month, your spending limit and credit factors are reported to all three major credit bureaus: Experian®, Equifax®, and TransUnion®.

You don't need to make a purchase on the Perpay Marketplace to get the credit-building benefits of Perpay+. The simple act of having your limit reported each month can help you build credit by lowering your credit utilization and increasing your available credit and depth of credit.¹

Take Your Credit to the Next Level

Use your spending limit to shop top brands in the Perpay Marketplace. Find what you need from electronics, home goods, apparel & more.**

Pay over time for your order through automated payments straight from your paycheck – no hidden fees or interest.

Your on-time payments will then be reported to all 3 credit bureaus to level up your credit building! You can buy what you need today, while building credit for tomorrow.

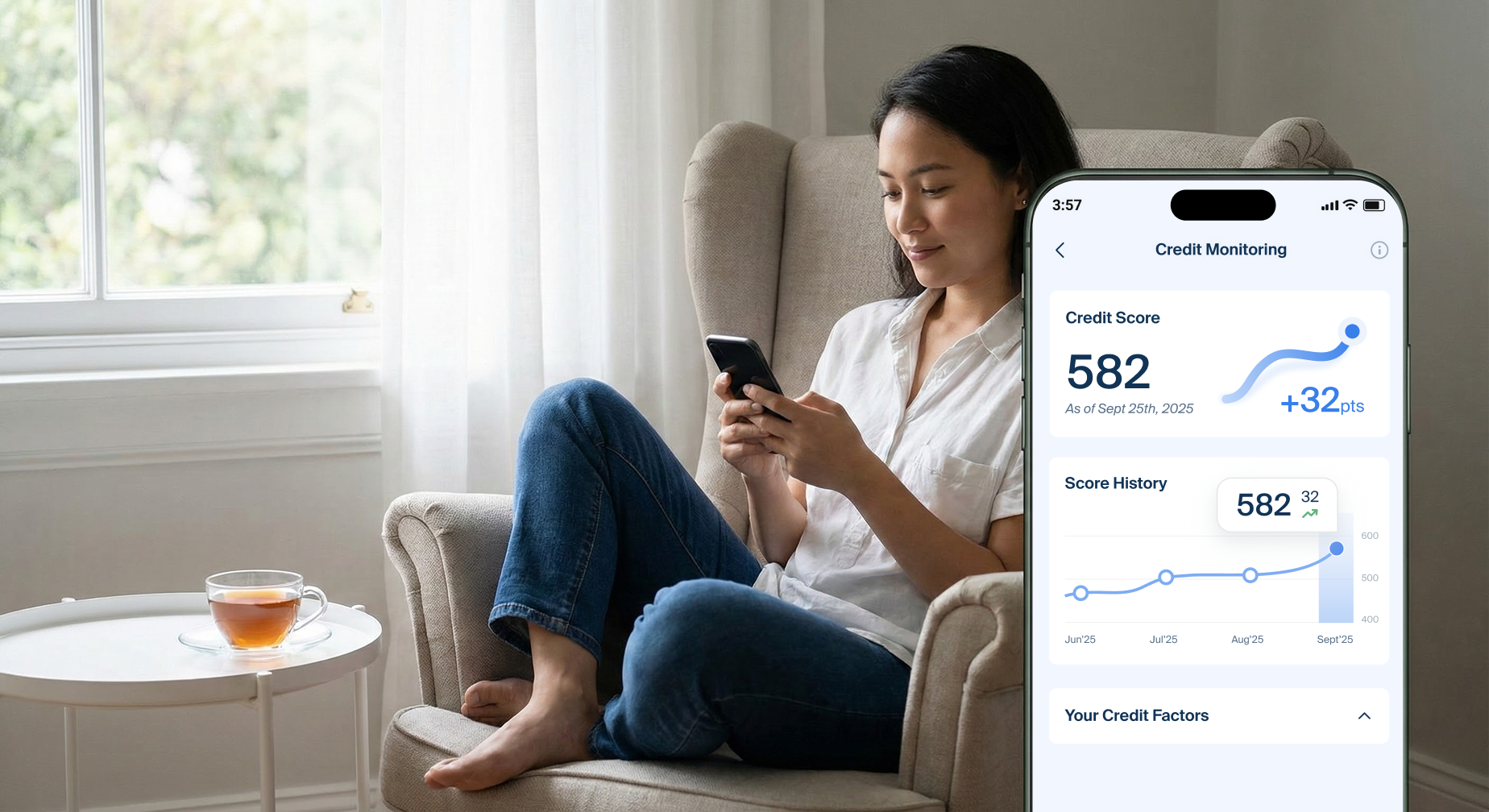

See your credit score increase by an average of 30+ points.***

The Power of Automatic Payments

One of the most helpful things about Perpay+ is how it handles payments. On-time payments are a huge part of a strong credit score, so Perpay makes it automatic and stress-free.

Simple Setup with Your Paycheck

To use Perpay+, you just set up a small direct deposit deduction from your paycheck to Perpay.

This direct deposit makes your $5 monthly Perpay+ payment automatic, so you don’t have to worry about missing a due date.

Connecting your payroll enables the credit reporting that helps you build your score.

Payments on Perpay Marketplace orders are made the same way. You would simply add your amount per payment for the order to your direct deposit deduction. For example, let’s say you’re paid monthly. Your Marketplace order is $10/pay and you’re a Perpay+ member. Your payment from each paycheck would be $15.

Why Automatic Payments Matter for Credit

Having an established payment history is one of the most important things for long-term credit growth.

The automatic payroll deduction helps ensure that the positive factor of on-time payment history from the Perpay Marketplace is working in your favor.

Track Your Progress and Keep Growing

A big part of building credit is seeing your score change and knowing what is helping it grow. Perpay+ gives you easy ways to keep an eye on your progress.

Easy Monitoring: You can track your credit score right in the Perpay app.

See Your History: Your credit score updates monthly, and the app shows you a graph so you can see how your score changes over time.

Know Your Factors: The app gives you insights into what is helping your score and where you can improve. For example, you might see factors like "100% payment of open loans," "New line of credit," and "0% utilization".

Your credit score is independently set by the credit bureaus, so the impact of Perpay+ can vary depending on your specific situation. However, by consistently reporting your spending limit, Perpay+ gives you the tools to help create a positive history.

The next chapter in your financial story is waiting. Learn more about getting started with Perpay+ today.

Frequently Asked Questions (FAQ)

What are the main benefits of Perpay+? Perpay+ is an affordable option that reports to all three major credit bureaus (Experian®, Equifax®, and TransUnion®). Perpay+ helps influence important credit factors, such as credit utilization, depth of credit, available credit, as well as payment history for Perpay Marketplace purchases. A higher credit score can unlock more financial opportunities for you over time.

Why do I need to connect my payroll direct deposit? Connecting your payroll direct deposit makes your monthly Perpay+ payments automatic. This consistent, automatic payment method enables Perpay to report your activity to the credit bureaus. You are always in control of your payments – Perpay does not have the ability to make changes to your payroll.

Is Perpay a trustworthy company? Yes. Perpay is a certified B-corporation that is focused on giving more people access to financial services. Members have used more than $839M in spending power.

What are the risks of using Perpay+? Like most financial products, it is important to know that missed payments may result in negative credit reporting to the bureaus, which could hurt your score. Also, Perpay+ does not remove any negative credit history you already have on your credit report. The goal is to build a positive history moving forward.

Sources:

* Applying for a Perpay account will not affect your FICO® or Vantage® score. However, we may obtain information from Clarity which may affect your credit profile with this alternative credit bureau.

**Access to the Perpay Marketplace is offered by Perpay, Inc., and is only available to eligible consumers residing in the United States. The Perpay Marketplace is subject to credit approval. Applying for a Perpay account will not affect your FICO® or Vantage® score. However, we may obtain information from Clarity which may affect your credit profile with this alternative credit bureau.

***The credit score (VantageScore 4.0) increase of 30+ Points is based on the average of approximately 50,000 Perpay+ customers with a baseline credit score of 550 or below during the first year of reporting. The same group observed an average credit score increase of 55 points over a two-year period if they maintained on time payments both on and off Perpay’s platform. Credit score improvement is not guaranteed, and individual results may vary based on a number of factors. Perpay will report your transactions to Experian®, Equifax®, and TransUnion®. On-time payment history can have a positive impact on your credit score. Late payments may result in payment reporting to credit bureaus that may negatively impact your credit score. This product will not remove negative credit history from your credit report. Perpay+ is only available to eligible Marketplace account holders. Fees apply. See the Perpay Terms and Conditions for more details.

⁺Credit score improvement is not guaranteed, and individual results may vary based on a number of factors. Perpay will report your transactions to Experian®, Equifax®, and TransUnion®. On-time payment history can have a positive impact on your credit score. Late payments may result in payment reporting to credit bureaus that may negatively impact your credit score. This product will not remove negative credit history from your credit report. Perpay+ is only available to eligible Marketplace account holders.

Perpay does not provide financial, legal, or regulatory advice. The content is for general informational purposes only. Any views expressed are those of Perpay, not its partner institutions. We do not endorse or guarantee the accuracy of any linked third-party information. Links to Perpay products are advertisements. All external brand names belong to their respective owners.